The journey to fuel efficiency: how Uber Freight has removed an estimated 4 million empty miles from its network since 2023

By Khalid Kayal, Sr. Data Scientist and Illina Frankiv, Head of Sustainability

Imagine throwing out a third of every meal you eat. That’s a lot of needless waste. Unfortunately, logistics today can be just as wasteful: Our research estimates that up to 35% of all miles driven by trucks on U.S. roads are hauling empty loads.

That figure represents a lot of time and fuel used to move nothing. Not all empty miles can be eliminated, but there are empty miles that are preventable. After conducting an analysis of shipment data in the Uber Freight network in 2023—and simulating network optimization techniques—our data scientists estimated that the freight industry could reduce empty miles by up to 64% through network optimization.

Most businesses struggle to address empty miles due to an imbalance between pickups and deliveries across the U.S. Many small or private carriers lack the tools needed to achieve visibility into available loads, preventing them from creating more fuel efficient routes or strategically pairing loads to capacity to minimize empty drive time. Shippers and carriers both need an easy-to-use optimization tool with a low cost barrier and wide network visibility.

At Uber Freight, our team is committed to leveraging a combination of technology, service, and market data to help customers make their logistics programs greener. Reducing empty miles is one of the core ways to drive more sustainable operations, and this starts with understanding the proportion of miles that are driven empty in a network. Our team of data scientists recently analyzed miles driven on our Brokerage platform over the span of 12 months to understand where and how empty miles occur in our network.

Methodology

As a logistics partner, it’s been historically challenging for our team to effectively measure empty miles, as we don’t have full visibility to our carriers’ itineraries, let alone their truck utilization during trips.

In the past, we attempted to quantify efficiency by comparing bundled loads (offered in the Uber Freight brokerage app as a bundle of loads and reloads with minimized deadhead) with organic bundled loads, in which carriers book those loads on their own at different times. We found that bundled loads result in fewer empty miles between drop-off and pickup. However, only 3% of Uber Freight brokerage loads get booked as a bundle so this approach did not use the rest of the loads in our network to determine empty mile efficiency.

Using the transportation technology at our disposal, we shifted focus to instead analyze data around load updates, such as dispatch time and pickup time, along with GPS pings we get from our carriers through our app to estimate the empty miles driven in our entire network.

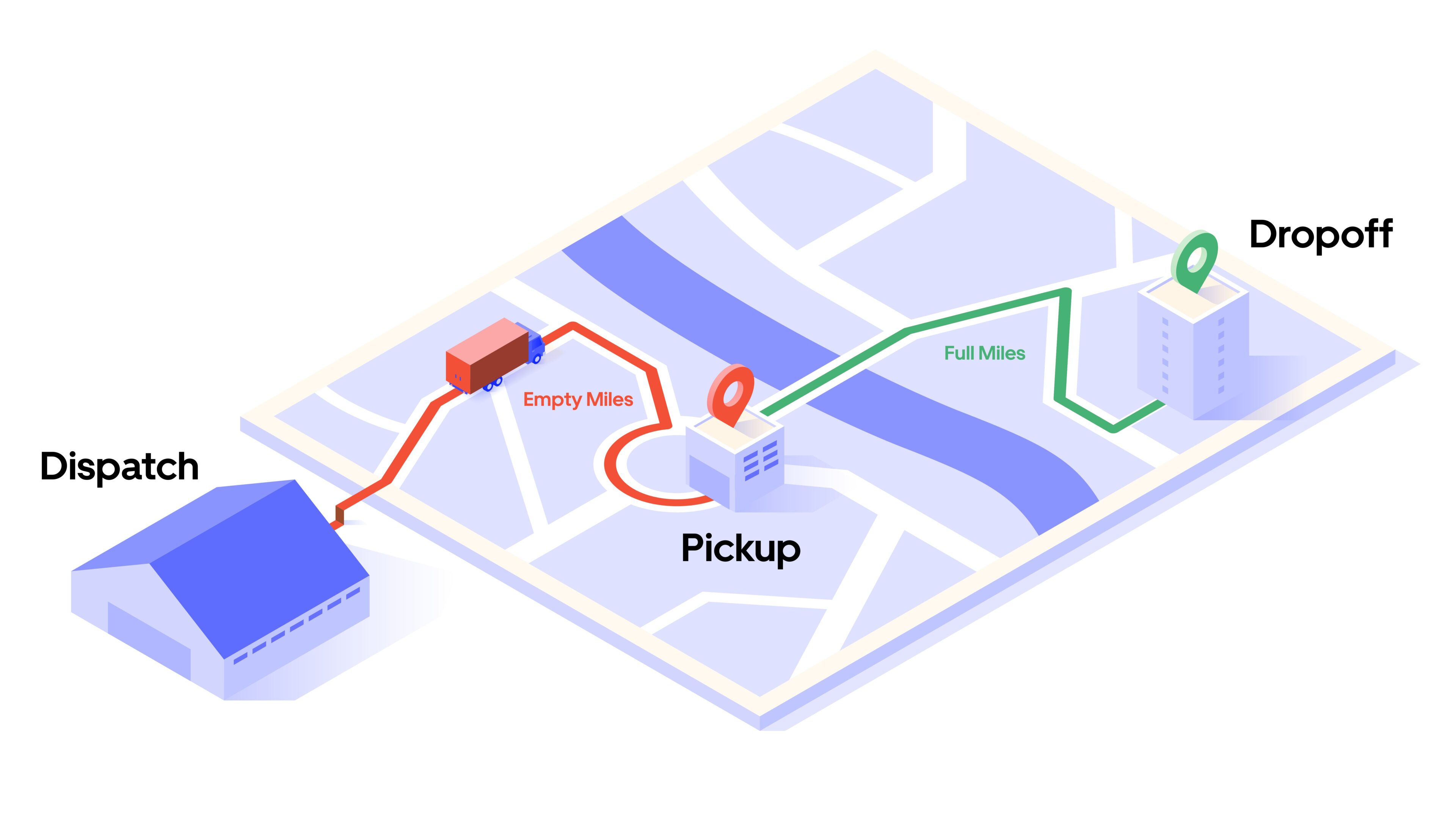

When a load is booked, the first signal we get from the carrier is the dispatch event, which indicates that the carrier is heading to pick up the load. This is when our empty miles tracking begins. A simple sequence of truck events would be:

- Dispatch

- Pickup

- Dropoff

We assume that the miles between dispatch and pickup are empty, whereas the miles between pickup and drop-off are full.

The power of dispatch data

As part of our efforts to estimate the time of arrival (ETA) to pickup, we log an event called dispatch time that can be captured by one or a mix of the following:

- The carrier provides an update through our app that they’re heading to pickup

- The tracking team calls the carrier and gets an update about the dispatch time

- GPS pings from the app show that the carrier is heading to pickup

Dispatch events are logged as a timestamp. Ideally, we want to capture this event using latitude and longitude coordinates, which help calculate the distance from the dispatch point to the pickup point.

To do so, we check all GPS pings coming from the driver around the dispatch time to capture the coordinates. As a conservative approach—to account for cases when the carrier was already heading to pickup before the tracking team called and updated the dispatch time—we count the first GPS ping available beginning 30 minutes prior to the dispatch event timestamp, and use that as the dispatch coordinates.

Here’s a snapshot of the entire trip that our team has visibility on:

Finally, we calculate the percentage of miles driven empty by taking the number of empty miles and dividing that by the total trip miles. For example, say a total trip amounted to 120 miles: 90 of those miles were driven full, while 30 miles were driven empty. To calculate the empty miles percentage, we’d divide 30 by 120 to discover that 25% of the miles on the trip were driven empty.

Our empty miles research assumptions

- For each trip, we included the first GPS ping we saw from 30 minutes prior to the dispatch time.

- We excluded trips where the empty miles driven were 10 or fewer, to avoid counting situations when the carrier said they had just dispatched, when it’s possible they were already near the facility.

- We added 20% to the geographical distance from dispatch to pickup since driving distance is longer than the geographical distance due to the network of roads as opposed to a straight line. For the full miles, we use PC Miler which is an accurate measure of truck routes.

The final results

While the freight industry can be inconsistent in their findings, most acceptable studies estimate empty miles between 15% – 35% [1]. At Uber Freight, we are uniquely positioned to measure empty miles in our network with precision by using GPS pings at dispatch, pickup, and drop off.

Using this methodology, we’ve seen empty miles on Uber Freight’s digital brokerage platform at 25% [2] of total miles in 2023 vs. 22% [3] of total miles in 2024. This translates to an estimated empty mile reduction of 4 million [4]. We then fit a regression model to obtain statistically significant results to help us better understand what’s driving the reduction. We found that:

- On average, if a load is part of a bundle, the empty miles are estimated to be reduced by 11.4 miles (per load) while controlling for other factors such as the total trip miles and the number of loads we offered as bundles at a lane level

- Organic bundles, where a carrier books a load and a backhaul on the Uber Freight network, had a similar effect. Each organic bundle was offered individually, but together satisfied Uber Freight’s internal criteria for bundled loads.

- Empty miles are estimated to be lower for loads that had another Uber Freight load dropped off by the same driver in the past 12 hours

- The pick up distance from top cities has a positive correlation with empty miles which is expected as remote facilities might require longer drive to reach

- Carrier cost is positively correlated with empty miles (higher cost correlates with higher empty miles)

- The hypothesis is that carriers are okay with driving extra empty miles if the price is high relative to market rates.

We understand that progress doesn’t stop here. Our goal for the future is to harness our real-time visibility tools to gain a more granular view of empty miles driven within our network, helping improve the accuracy of our research.

In turn, these findings can help us work with our shippers to pinpoint the most efficient steps they can take, such as load bundling and route optimization, to reduce the empty miles driven in their network for the long term.

Footnotes:

[1] Estimates of empty miles traveled by tractor-trailer trucks in the US vary between 15% and 35%. The American Transportation Research Institute (ATRI) estimates fleets’ empty miles at 14.8%, and FreightWaves SONAR puts them at 16%. These estimates are mostly based on medium and large fleet surveys, which are more efficient than smaller fleets and owner-operators. Some studies argue that fleets significantly underreport their empty miles, which could be in excess of 35%. Our analysis of vehicle miles traveled (VMT) shows that empty miles likely fall on the higher end of the range. US Trucks move approximately 300 million truckloads annually (ACT Research). For hire fleets move truckloads with an average length of haul (LOH) of about 450 miles. The average LOH for private fleets is 238 miles per load. Tractor-trailers travel about 103 billion miles loaded per year. In comparison, the US Bureau of Transportation Statistics estimates the annual mileage of tractor-trailers at 175 billion miles. Assuming 10% of these miles are traveled by LTL trucks, we estimate that the fraction of empty miles traveled by US truckload fleets is approximately 35% and use this figure as the industry’s empty miles baseline. Please refer to our whitepaper for more details and references.

[2] Based on Uber Freight Brokerage only data from Sept 2022 – August 2023, capturing 286K loads in 8265 market lanes. Empty-mile performance is based on the proportion of empty miles out of the total miles driven to execute one load on the Uber Freight Brokerage platform.

[3] Based on Uber Freight Brokerage only data from September 2023 – August 2024, capturing 263K loads in 8297 market lanes. Empty-mile performance is based on the proportion of empty miles out of the total miles driven to execute one load on the Uber Freight Brokerage platform.

[4] To compare 2024 vs. 2023 empty mile performance, we used the average 2023 empty miles percentage from full miles as a counterfactual for 2024 loads to ensure that the delta wasn’t only based on volume change.